Ryan & I have both been self employed for a few years now. Neither of us have set days of the month when we get paid and my income sometimes varies a lot from month to month while his sometimes varies a little. We were a little unprepared for a few surprises that came with being self employed the first year. We’ve learned a lot about budgeting and managing our finances with an irregular income in the last couple of years. Here are my 5 tips for managing your budget with a self employed irregular budget.

1. Base your monthly budget on a bad month. If you set your monthly budget based on your average monthly income, you’ll have months where you make less than average and won’t have enough money to go around. We looked at the previous 12 months and based it on the very worst month. On less-than-average months we still have enough to meet our needs and on good months we have extra to set aside for savings.

2. Get a month ahead on bills as soon as possible. It wasn’t easy, but eventually we managed to get a month ahead. Meaning, we pay February’s bills with the money that we earned in January. Even if the bulk of February’s income comes in at the end of the month, we can still pay bills due in early February on time because we aren’t relying on February’s income for them.

3. Budget for everything. At first we budgeted for our regular bills and groceries. This was a problem because I wasn’t budgeting for birthdays, anniversaries, holidays and other less-often-than-monthly expenses. Having a birthday and a holiday in the same month can really throw the budget off. Don’t forget the small stuff like yearly family photos, vehicle tags & registration renewal, or extra grocery money for holidays.

4. Set aside money for taxes in advance. When you have a traditional employer, taxes are withheld all year long which helps you out for income tax time. If you are self-employed, it’s your responsibility to set that money aside and if you don’t, tax season will be financially difficult. We talked to an accountant to get an estimate for what percentage of our income we should set aside to prepare for income tax payments.

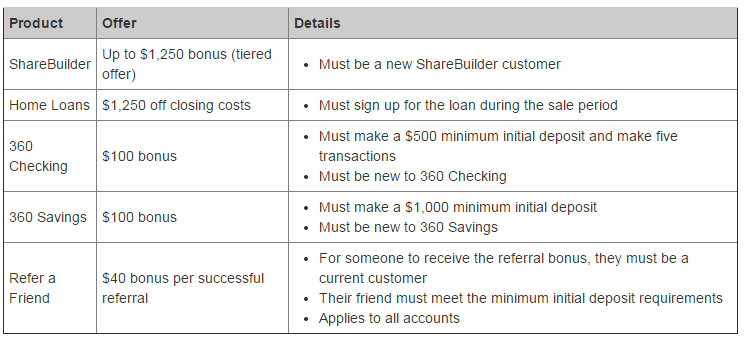

5. Shop around for the best banking option for your family. Capital One offers fee-free checking and savings accounts that let you earn interest. Capital One is offering a black friday deal to help your family stay on track with your financial goals through the holiday season. They are offering new account bonuses, referral bonuses and closing cost credits. Details of the Capital One Black Friday Deals are below and will last through December 1st 2014 at 11:59pm!

Do you have a sporadic income? What advice do you have for keeping on a budget?

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

Hi there! I am Emily Evert, the owner of Emily Reviews. I am 28 and live in a small town in Michigan with my boyfriend Ryan and our two pugs. I have a large family and I adore my nieces and nephews. I love reading memoirs, and learning about child development and psychology. I love watching The Game of Thrones, Teen Mom, Sister Wives and Veep. I like listening to Jason Isbell, John Prine, and other alt-country or Americana music. I created Emily Reviews as a creative outlet to share my life and the products that I love with others.

This post currently has one response.

I am due for checking around for some different financial institutions since I’m seeing new fees. I don’t know if it’s due to the interest rate raises but there are so many choices out there that it does pay to do your research and plan ahead.